The payment settlement process is an essential aspect of financial systems, enabling the transfer of funds between parties. It involves a series of steps, starting with the authorization of payment and ending with the settlement of funds.

There are different types of payment settlement systems, including Real-Time Gross Settlement (RTGS), Automated Clearing House (ACH), and wire transfer systems.

The payment settlement process involves several key parties, including the payee, payer, payment gateway, acquiring bank, and issuing bank. Understanding the payment settlement process is crucial for individuals and businesses.

This article provides an overview of payment settlement processes, including the various types of payment settlement systems, the key parties involved, and the steps involved in the payment settlement process.

What is the Payment Settlement Process?

First, understand “What is the Payment Settlement?” The payment settlement is the process of transferring funds between two parties to complete a financial transaction. In the context of eCommerce, payment settlement refers to the process of transferring funds from the customer’s account to the merchant’s account for a purchase made on an eCommerce website.

Payment settlement is a critical aspect of eCommerce, as it ensures that merchants receive payment for their products and services, and customers receive the products and services they have purchased.

Now “What is the Payment Settlement Process”? The payment settlement process refers to the process of settling transactions between two or more parties, typically involving the transfer of funds from one party to another.

Payment settlement processes are an essential aspect of financial systems, facilitating the smooth and efficient flow of funds between parties.

Steps involved in the Payment Settlement Process

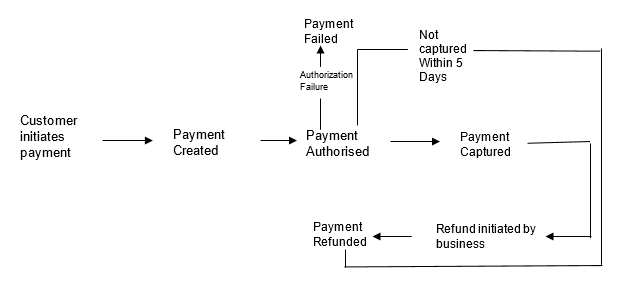

The payment settlement process typically involves the following steps:-

- Payment Authorization

The payment gateway processes the payment and sends a request to the acquiring bank to verify the payment details and authorize the transaction.

- Verification

The acquiring bank verifies the payment details, such as the customer’s account balance, credit limit, and payment information, and authorizes or declines the transaction.

- Fund Transfer

If the payment is authorized, the payment gateway transfers the funds from the customer’s account to the merchant’s account.

- Payment Settlement

Once the funds have been transferred, the payment settlement process begins.

- Reconciliation

The acquiring bank and payment gateway reconcile the transaction data to ensure that the payment has been processed.

- Reporting

The payment gateway and acquiring bank generate reports to provide the merchant with transaction details, including payment amounts, fees, and settlement timelines.

Types of Payment Settlement Process

There are different types of Payment Settlement Systems. There are the 3 main types of payment settlement systems are:-

- Real-Time Gross Settlement(RTGS)

Real-Time Gross Settlement (RTGS) system is a payment settlement system where transactions are paid immediately and individually. In an RTGS system, funds are transferred from one bank account to another on a real-time basis.

- Automated Clearing House(ACH)

The Automated Clearing House (ACH) system is a payment settlement system that processes transactions in sets. In this system, transactions are processed and settled in bulk, typically at the end of the day.

- Wire Transfer System

A wire transfer system is a payment settlement system that facilitates the transfer of funds between banks and financial institutions. In this system, funds are transferred electronically.

Key Parties involved in the Payment Settlement Process

First, we understand “What are Key Parties?” Key parties refer to individuals, groups, or organizations that are critical to the success of a project, transaction, agreement, or other business. These parties have a vested interest in the outcome of the venture, and their involvement is necessary for its successful completion.

The payment settlement process typically involves several key parties, including:-

- Payee

The payee is the party that receives payment for goods or services. The payee can be an individual, business, or financial institution.

- Payer

The payer is the party that creates payment for goods or services. The payer can be an individual, business, or financial institution.

- Payment Gateway

A payment gateway is a technology platform that facilitates the transfer of funds between the payer and the payee.

- Acquiring Bank

The acquiring bank is the bank that processes payments on behalf of the merchant.

- Issuing Bank

The issuing bank is the bank that issues payment cards to customers.

Overview

The payment settlement process is a critical aspect of financial systems, facilitating the transfer of funds between parties. Understanding the steps involved in the payment settlement process is essential for businesses and individuals alike to ensure secure and efficient payment processing.

- Payment Authorizations

- Verification

- Fund Transfer

- Payment Settlement

- Reconciliation

- Reporting

Also Read More: Digital Payments: New Trends and Opportunities